Like my previous blog titled how to make money in share market?, in this blog I will talk about a unique method to get maximum profit from intraday trading.

One of the important factors that plays vital role for the success of this method is analysis of past trend. If an investor is able to find out the likely movement of price using the past trend then this method can be used for generating profits in shorter period of time.

So, how to get maximum profit from intraday trading??

There is no specific name of this method as this is not a recognized but for the sake of memorizing this method, you can call it as “Purchasing a stock at 3 levels”.

How to use this method to increase your profit from intraday trading?

Step 1:

Search for such a stock whose price is going to be high for that day. It is not that much tough as we think and one can easily find out the likely movement of the stock for intraday.

Step 2:

If your analysis says that yes, the stock of XYZ ltd will go up then it’s time to follow on this method otherwise you need to find another stock whose price is going to be up for the day.

Step 3:

What one needs to do after finding out such a stock which meets the above criteria is to purchase that stock at current market price to earn profit for the day.

Note:

- Purchase the share only if you think it will go up and will give at least 1 – 2% return for the day in normal circumstances.

- Do not purchase a large quantity of that stock (Reason for the same is explained in the coming section).

Step 4:

Wait for the movement when it goes down by 1 – 3% then purchase a larger quantity of that stock (In case you find that the price of the mentioned stock is not going down and going high then this method is not more of use for you and in such a case you can sell your share at some higher price to earn profit from that stock).

Note: If price goes down, you have to make sure that the fall in price is temporary and it will reach at its earlier position (where you purchased it first time).

Step 5:

Wait for the movement when the price of the stock further goes down by 1 – 3% and at that moment you need to purchase a larger quantity of that stock once again.

Note: You can skip this step if you find that after purchasing the same stock twice, its price is going high and you need to follow next step.

Step 6:

Now when it reaches at your expectation level or say a little bit down than your expected price, it’s time to sell all the shares you have purchased till now (shares of the mentioned company).

How this method works?

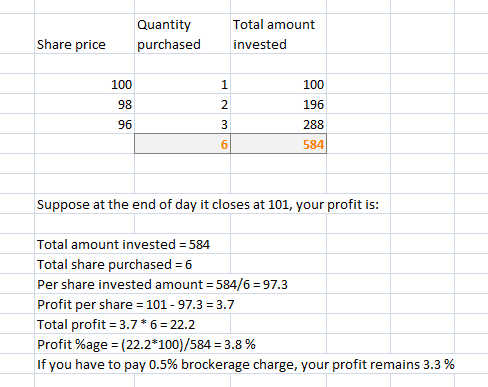

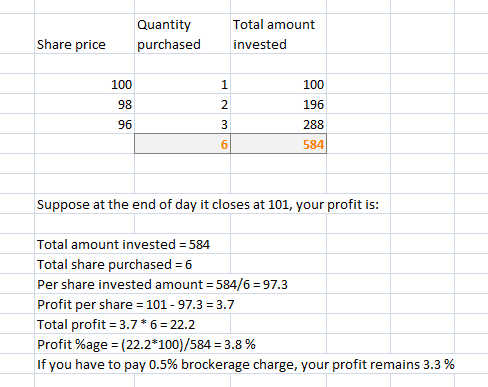

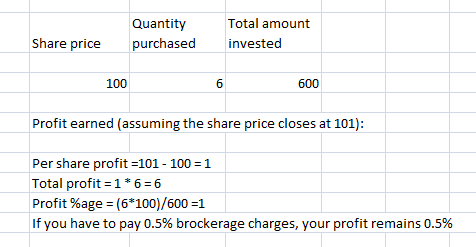

Suppose you analysed a stock whose current market price is INR 100 and you expect it to increase by 2 – 2.5% for the day. Lets assume that you have purchased only 1 share at current market price. Your total investment for the time is INR 100. This method says that if price goes down rather than going up, you need to purchase more shares. Now lets assume that price has gone down by 2 percent and reached to INR 98. Now it’s time to purchase more shares. You have purchased 2 more shares at this price. Your total investment for the time is 296 (100 + 196) and total no. of shares is 3. The price of the share is further going down on temporarily basis and if we follow this method, we have to buy more quantity of the same stock at that reduced price. Assume that price has reached at INR 96 and you have purchased 3 more shares at this price. Now, for the time, your total investment is 584 (296 + 288) and total no. of shares is 6. Now it’s time to calculate your profit assuming that at the end of the day the share closed at 101 (below your expectation level).

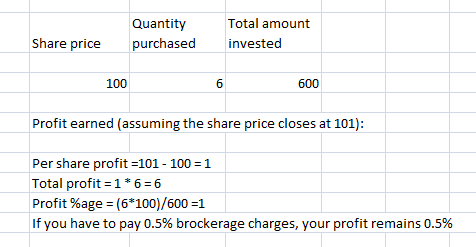

On the other hand in expectation of 2% profit, if you purchase 6 shares at current price, your profit will be:

Disclaimer: MonetarySection.com will not be any way responsible for trading losses incurred using any of the techniques/ methods mentioned on this website.