Income Tax:

Income tax is amount of tax levied upon income of an individual earned during a financial year.

Taxable Income:

Taxable income computation is first step in calculation of income tax. Income tax is calculated on annual taxable income and deduct every month from income of an individual on average basis. Total Income is sum of YTD and prorated income.

Income tax computation:

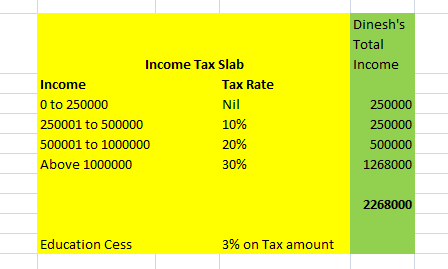

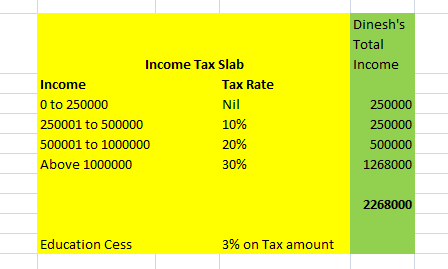

Tax is applicable on the basis of income tax slab which categorizes income and rate of tax levied on each category.

For example Dinesh was born on 26 July 1985. He is working in XYZ Ltd. His taxable income for the financial year 2015 – 2016 is 22,68,000. Tax rate applicable for his income would be like this:

Now, based on the above categorization, computation of tax for Dinesh’s income can be done as follows:

Because on the income below 250000, tax amount is nil, so Dinesh won’t have to pay any tax on the this amount i.e. 250000.

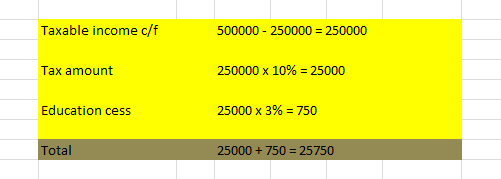

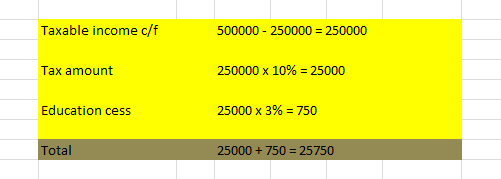

On income in excess of 250000 (but less than 500000), he will have to pay a tax of 10% plus 3% of tax amount as education cess:

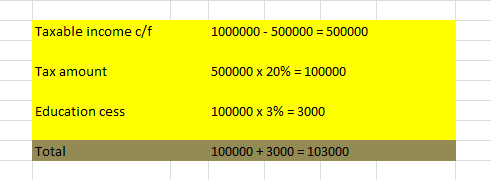

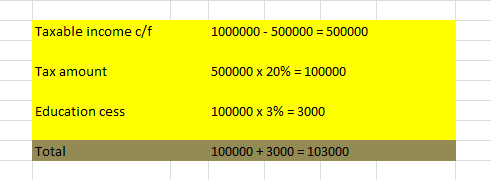

Now on income in excess of 500000 (but less than 1000000) he will have to pay 20% tax plus 3% of tax amount as education cess:

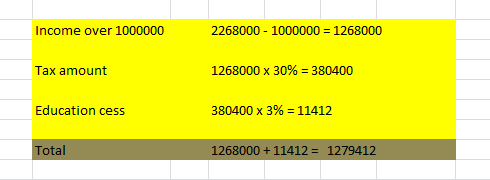

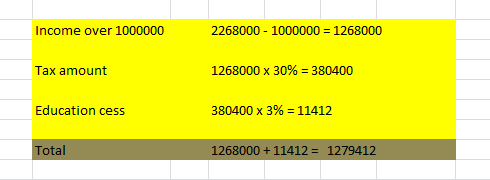

Dinesh’s income is more than 10,00,000. So he will have to pay 30% tax and 3% of tax amount as education cess on the income in excess of 1000000.

Total tax payable for Dinesh would be:

25750 + 103000 + 1279412 = 520562

Note: Surcharge is not applicable on Dinesh’s income as his total taxable income is less than 10000000. Also Dinesh is not eligible for rebate u/s 87A as his total taxable income is more than 500000.