An underlying asset is the financial asset upon which a derivative’s price is based.

Often stocks, bonds, commodities, currencies, interest rates and market indexes are considered as underlying assets.

An underlying asset is the financial asset upon which a derivative’s price is based.

Often stocks, bonds, commodities, currencies, interest rates and market indexes are considered as underlying assets.

Table of Contents

Understand the meaning of basic salary, gross salary and net salary:

Basic salary is the amount paid to an employee before any extras are added or taken off. Added extras include HRA, DA, Transport Allowance etc. whereas deductions include Provident Fund, Employee State Insurance etc.

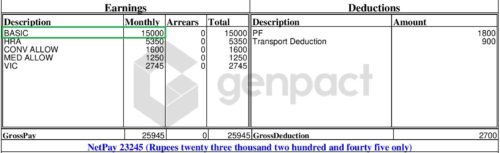

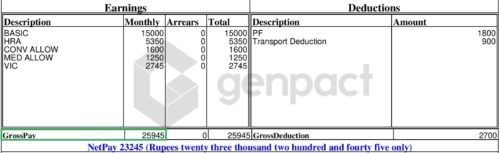

In the attached screenshot, basic salary is Rs 15,000.

Gross salary (also called gross pay) refers to pay components which an employee receives in return of his/ her service. These pay components are categorized as recurring and non – recurring pay components. In other words, whatever an employee receives from employer as part of salary constitutes gross salary.

Gross salary = Basic salary + Recurring pay components + Non – recurring pay components

Read: What are the different components of gross salary?

In the above screenshot, the total of all the pay components (Basic salary, HRA, Conveyance allowance, Medical allowance and VIC) is Rs 25,945 which is gross salary.

Net salary also referred as ‘Take home salary’ is the amount which is left after deductions like PF, EPS, Advance etc.

Net salary = Gross salary – Deductions

In the above screenshot, the difference of gross salary and deductions is Rs 23245 which is net pay.

Chattel mortgage is debt instrument in which loan is extended to borrower on movable property.

Usually land and buildings are used as mortgage however when personal movable properties like appliances, car, jewelry, etc. are used rather than non movable properties, it is called a chattel mortgage.

Strike price is the fixed price at which holder of a call option can buy the underlying asset irrespective of its market price until the expiration of contract.

For a put option holder, it is the price at which underlying assets can be sold until the expiration of contract.

The strike price is determined at the time of entering into a derivative contract.

In a call option, if it remains lesser than the spot price (market price), the holder can exercise the option to earn profit.

On the other hand, in a put option, the holder of the option can earn profit only if strike price is more than the market price.

On 1st January 2018, Mr A entered into a derivative contract to buy 100 shares of company XYZ Ltd at a strike price of INR 85. The expiration date of contract is 3 months i.e. 31st March 2018. On 1st of January the market price was INR 82.

In the month of February, market price increased from INR 82 to 97. Mr A has the right to purchase the 100 shares of XYZ ltd at a price of INR 85 or Mr A can wait for further hike in share price till the expiration of contract.

In the month of February, market price increased from INR 82 to 97. Mr A has the right to purchase the 100 shares of XYZ ltd at a price of INR 85 or Mr A can wait for further hike in share price till the expiration of contract.

In the month of February, market price increased from INR 82 to 97. Mr A has the right to purchase 100 shares of XYZ ltd at a price of INR 85 or Mr A can wait for further hike in price till the expiration of contract.

The below given income tax slab is applicable for financial year 2018 – 19 and assessment year 2019 – 20.

Income tax slab for financial year 2018 -19 & assessment year 2019 – 20

(Amounts are in Indian rupees)

| Rate | Men | Women |

| Exemption limit | Up to 2,50,000 | Up to 2,50,000 |

| 5% of taxable income | Income between 2,50,001 to 5,00,000 | Income between 2,50,001 to 5,00,000 |

| 20% of taxable income | Income between 5,00,001 to 10,00,000 | Income between 5,00,001 to 10,00,000 |

| 30% of taxable income | Income more than 10,00,000 | Income more than 10,00,000 |

For Senior citizens (Age between 60 and 80) and very senior citizens (Age above 80):

| Rate | Senior citizens | Very senior citizens (Aged 80 and above) |

| Exemption limit | Up to 3,00,000 | Up to 5,00,000 |

| 5% of taxable income | Income between 3,00,001 to 5,00,000 | Nil up to 5,00,000 |

| 20% of taxable income | Income between 5,00,001 to 10,00,000 | Income between 5,00,001 to 10,00,000 |

| 30% of taxable income | Income more than 10,00,000 | Income more than 10,00,000 |

Surcharge: 10% of tax amount, where taxable income is between 50,00,000 to 1 crore.

15% of the tax amount, where taxable income is more than 1 crore.

Health and Education Cess : 4% of tax amount along with surcharge.

Rebate: As per section 87A of Income tax act 1961, rebate of INR 2,500 will be given to those individual tax payers whose total taxable income doesn’t exceed INR 3,50,000.