Table of Contents

Liquid liabilities are debt obligations which a firm has to pay within a year.

These liabilities are calculated by deducting the amount of bank overdraft and cash credit facilities (these must be excluded only if they become a permanent mode of financing) from total amount of current liabilities.

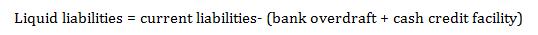

Formula for the calculation of liquid liabilities:

Below formula can be extracted from the given definition:

Why these liabilities are calculated?

These liabilities are calculated to gauge the firm’s ability to meet its short term liabilities. The calculated figure of these liabilities is used in the calculation of ‘Acid test ratio’ or ‘Quick ratio’. This ratio directly indicates the ability of a firm to meet its short term debt obligations.

nice post

Very informative post